If you’re an Indian entrepreneur ready to launch your Shopify store, you’ve probably already discovered one frustrating truth:

Shopify Payments isn’t available in India.

Instead of the “plug-and-play” convenience available in countries like the US or the UK, India-based Shopify merchants struggle with limited gateway options, compliance hurdles, and slower settlement timelines.

And for those targeting international customers, it gets trickier: currency conversions, RBI regulations, and global trust issues can impact your sales.

The right payment setup, however, can boost your conversion rates, improve customer trust, and make global expansion possible.

In today’s doola guide, you’ll learn:

- The best Shopify India payment gateways in 2025 (domestic & global)

- Tax tips so your transactions are tracked and your business is compliant

Let’s get you paid smoothly, securely, and globally, with doola as your formation and compliance partner.

Overview of Payment Gateways for Shopify in India

In India, you don’t have the luxury of clicking “Enable Shopify Payments” and calling it a day.

Instead, you’ll have to choose the right third-party gateway, one that handles local preferences like UPI and wallets, works smoothly on Shopify, and keeps you compliant with both Indian and international regulations.

Your choice of payment gateway can:

- Boost your conversion rates by reducing payment failures

- Strengthen customer trust with familiar, reliable checkout options

- Improve cash flow by ensuring faster settlements

- Expand your sales reach from Delhi to Dallas

Why Shopify Payments Isn’t Available in India

Shopify Payments is powered by Stripe, but Stripe doesn’t yet offer direct accounts for Indian-registered businesses.

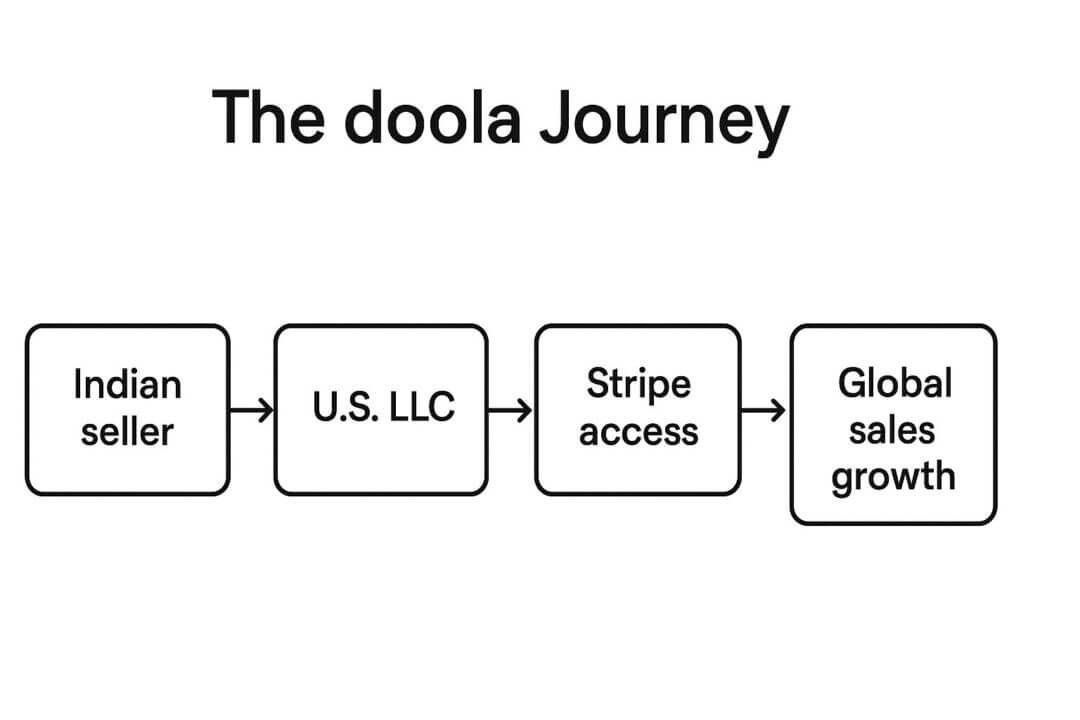

That means you’ll need to integrate with third-party providers for domestic transactions and consider workarounds, like forming a US LLC, to unlock Stripe for global sales.

What Are the Best Shopify India Payment Gateways?

You have two options when it comes to selecting the best Shopify India payment gateway – domestic and international. Below we cover each one in detail.

The best domestic Shopify India payment gateways are:

The best international Shopify India payment gateways are:

- Stripe (via US LLC formation)

Let’s dive in and help you pick the right one from the various domestic and international options for the best Shopify India payment gateways:

Domestic-Focused Gateways for Shopify India

These gateways are built for local-first selling, perfect for customers who prefer UPI, netbanking, or digital wallets.

They integrate with Shopify, meet RBI compliance requirements, and offer payout timelines that keep your cash flow healthy.

1. Razorpay

Best for: Indian Shopify sellers who want maximum local coverage with UPI, cards, and wallets plus easy Shopify integration.

Razorpay is the go-to modern payment gateway for Indian e-commerce. With its official Shopify app, setup takes minutes. It supports UPI, credit/debit cards, netbanking, and popular wallets.

Add-ons like subscription billing, payment links, and instant refunds make it a versatile choice for D2C brands.

Pros:

- Plug-and-play Shopify integration, can connect your store in minutes

- Supports major Indian payment methods (UPI, netbanking, wallets, cards)

- Competitive fees: 2% + GST (domestic), affordable for small businesses

- Predictable payouts (T+2 business days) help plan inventory cycles better

Cons:

- Limited global payment reach compared to Stripe/PayPal, not best for overseas scaling

- Some international card transactions may fail due to Indian banking restrictions

2. PayU Money

Best for: Sellers wanting a trusted, no-frills domestic payment processor with strong reliability.

One of India’s longest-standing payment processors, PayU Money offers a stable and secure platform for domestic Shopify sales. It covers all major Indian payment methods and has a reputation for consistent service.

Pros:

- Simple Shopify integration process with quick setup, ideal for first-time Shopify sellers

- UPI, cards, wallets, and netbanking supported, covers Indian payment preferences

- Flat 2% + GST fees for domestic transactions, helps with predictable cost planning

- Well-established brand in India, trusted by thousands of Shopify merchants

Cons:

- Lacks subscription billing, in-depth analytics dashboard, or instant settlement options

- Newer payment methods or integrations take months to become available, which puts fast-scaling sellers at a loss

3. Paytm

Best for: Stores targeting wallet-first or UPI-heavy audiences, especially in Tier 2 and Tier 3 cities.

Paytm is synonymous with digital payments in India. Its wallet is widely used, and its UPI adoption is massive. If your audience prefers wallet balances or QR-code UPI payments, Paytm is a strong choice.

Pros:

- Massive user base (300M+ registered users) and brand reputation boosts buyer trust

- Fast settlements (T+1–T+2 days), helping with quicker cash flow

- Affordable fees: 1.99% + GST, keeps transaction costs low

Cons:

- Shopify integration may require developer intervention or third-party apps for proper setup

- Primarily domestic, minimal global payment acceptance (less ideal for cross-border e-commerce)

4. Cashfree

Best for: Shopify merchants who want low domestic fees and BNPL (Buy Now Pay Later) support.

Cashfree is known for affordability and flexibility. It offers UPI, cards, wallets, and Pay Later options that can boost average order value.

Pros:

- Lower fees (1.75-2% + GST) let small / mid-sized merchants keep more of their margins

- Supports modern BNPL checkout methods, helps with higher cart sizes and conversions

- T+2 day settlement cycle, quick access to funds, helping with cash flow planning

Cons:

- Might require developer involvement or custom tweaks for smooth Shopify functionality

- While excellent for India-focused stores, cross-border payment options and currency support are not as extensive as international gateways

5. Instamojo

Best for: Small businesses and first-time e-commerce sellers who need quick setup and extra tools like invoicing.

Starting out as a payment link service, Instamojo has grown into a full payment gateway with added perks like online store hosting and digital product sales support.

Pros:

- Very easy setup, ideal for beginners (get started in minutes without technical skills)

- UPI, cards, and wallets supported, covers all popular domestic payment options

- Extra features: invoicing, online store builder (lets you sell even without a full website)

Cons:

- The per-transaction flat fee can eat into margins for low-ticket products

- Slower access to funds compared to competitors, which might affect cash flow for small sellers

International-Focused Gateways for Shopify India

If you’re targeting customers abroad, you need global-recognized brands, multi-currency support, and trust-boosting checkout logos. These gateways handle foreign cards, wallets, and compliance for cross-border sales.

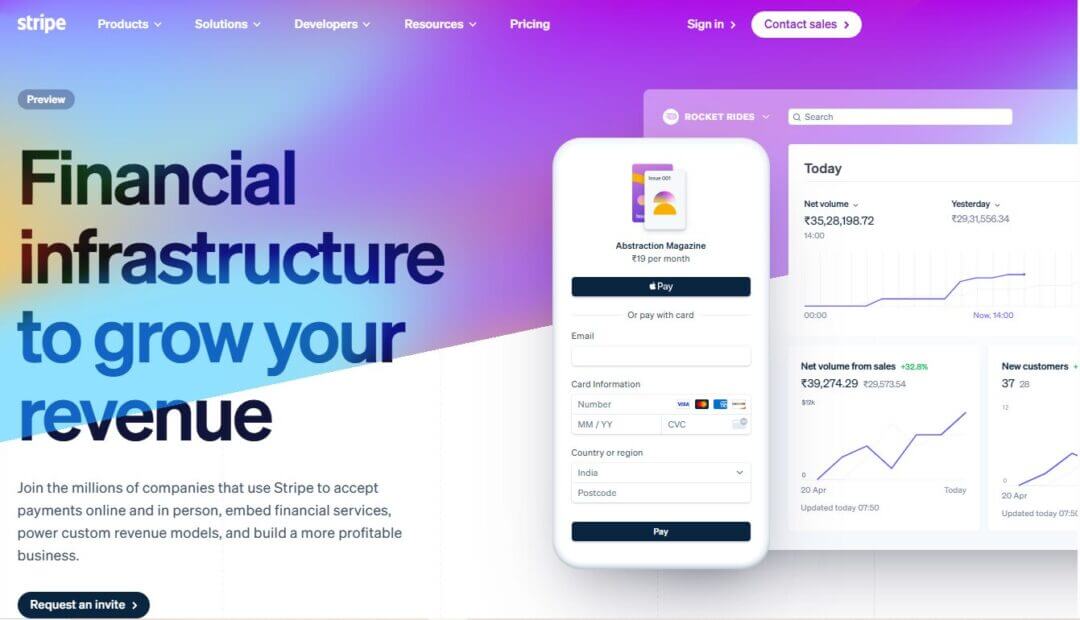

1. Stripe (via US LLC Formation)

Best for: Ambitious brands with global-first strategies looking for seamless Shopify Payments integration.

Stripe powers Shopify Payments in most countries, but not in India. The best workaround is to form a US LLC, get an EIN, and open a US bank account, then connect Stripe natively to Shopify. The result: frictionless global payment acceptance.

Pros:

- Connects directly with your Shopify store without third-party workarounds, reducing failed transactions and improving checkout speed

- Perfect for targeting global buyers, especially those preferring local payment methods

- Improves cash flow compared to other gateways with longer settlement times

- Stripe is a widely recognized and reputable payment processor, boosting buyer confidence

Cons:

- You’ll need to set up and maintain a US LLC, which means ongoing filing and compliance costs

- Even if you operate outside the US, you’ll have to stay on top of IRS reporting and potential tax liabilities

2. PayPal Business

Best for: Indian merchants who want immediate access to international buyers without setting up a foreign entity.

PayPal is the world’s most recognized online payment brand, trusted by millions of customers globally. Adding it to your Shopify checkout can significantly boost trust and conversions for overseas buyers.

Pros:

- No need for a US or overseas entity; you can start collecting international payments with your existing Indian business credentials

- Reach buyers in almost every major e-commerce market, making it ideal for cross-border sales

- Can be added in minutes without complex technical setup

- PayPal’s brand recognition can reduce cart abandonment, especially for new customers wary of sharing card details

Cons:

- Costs can add up quickly on larger transactions, eating into profit margins

- Slower cash flow compared to faster payout gateways like Stripe

- PayPal’s exchange rates are less favorable than banks or dedicated FX providers, which can further reduce your net earnings

Comparison: Shopify Payment Gateways in India for 2025

Gateway

Supported Methods

Fees (Domestic)

Settlement Time

Integration Ease

Eligibility

Brand Trust/Security

Razorpay

UPI, Cards, Wallets, Netbanking

2% + GST

T+2 days

Easy (Shopify app)

Indian business

PCI DSS Level 1

PayU Money

UPI, Cards, Wallets, Netbanking

2% + GST

T+2 days

Easy

Indian business

PCI DSS Level 1

Paytm

UPI, Wallet, Cards

1.99% + GST

T+1–2 days

Moderate

Indian business

PCI DSS

Cashfree

UPI, Cards, Wallets, Pay Later

1.75%–2% + GST

T+2 days

Moderate

Indian business

PCI DSS Level 1

Instamojo

UPI, Cards, Wallets

2% + ₹3

T+3 days

Easy

Indian business

PCI DSS

PayPal

Cards, PayPal wallet

4.4% + fixed fee

T+3–5 days

Easy

Indian business

Global PCI DSS

Stripe (via US LLC)

Cards, Wallets, ACH, Apple Pay, Google Pay

~2.9% + 30¢

T+2 days

Easy (Shopify native)

US business

PCI DSS Level 1

Best Payment Gateway for Shopify India in 2025

In 2025, Shopify merchants in India have a wider range of options than ever, but the best choice depends entirely on your market focus: domestic, international, or both.

In this section, we will help you choose the right payment gateway that blends seamlessly with your store and keeps your cash flowing without unnecessary delays or hidden costs.

Our Evaluation Criteria

Here’s a list of factors we’ve considered when testing and ranking the best payment gateways for Shopify India:

1. Ease of Integration

Whether Shopify-native or plugin-based, the process should be intuitive, well-documented, and require minimal developer intervention.

2. UPI & Wallet Support

UPI and mobile wallets are non-negotiable for Indian customers. We looked for gateways that offer frictionless UPI integration and support for popular wallets.

3. Competitive Fees

Transparent, predictable pricing is crucial. We favored gateways that clearly spell out transaction fees, avoid hidden charges, and offer rates that don’t erode your profit margins over time.

4. Settlement Speed

Faster settlements mean you can reinvest sooner. We prioritized gateways that consistently transfer funds quickly, so you can maintain a healthy cash flow.

5. Global Reach

For merchants eyeing international buyers, we rated gateways higher if they supported multiple currencies, accepted global cards, and offered wide geographical coverage without high foreign transaction fees.

6. Compliance Simplicity

From RBI guidelines to tax documentation, compliance is tricky. We preferred gateways that minimize legalities and paperwork, so you can focus on selling.

For Domestic Sales:

- Razorpay is the clear winner – It’s built for Indian merchants and offers seamless Shopify integration with strong local compliance.

- Shopify app for quick setup – Installation takes just a few clicks, with no heavy coding or long approval cycles.

- Supports UPI, cards, netbanking, and wallets – Ensures you cover every major payment preference for Indian customers.

- Competitive fees at 2% + GST – Keeps transaction costs low while maintaining a robust feature set.

- Reliable settlement (T+2 days) – Funds are deposited within two working days, improving cash flow predictability.

For International Sales:

- Stripe via a U.S. LLC + PayPal Business is the gold standard – This combination maximizes reach and conversion rates for cross-border ecommerce.

- Accept payments from 200+ countries – Capture a truly global customer base without compatibility issues.

- Multi-currency support – Display prices and accept payments in your customer’s local currency for higher trust and fewer cart abandonments.

- Direct integration with Shopify – No complex middleware needed; connect and start selling internationally right away.

- Builds customer trust with globally recognized brands – Stripe and PayPal logos boost credibility and reassure buyers worldwide.

Gateway Choice by Seller Profile

When it comes to choosing the best fit, your ideal payment gateway depends on your business model and market focus.

| Seller Profile | Best Choice | Why |

| Domestic-only startup | Razorpay | Easy setup, UPI + cards, affordable fees |

| Domestic + occasional international | Razorpay + PayPal | Covers UPI and global card payments |

| Global-first D2C brand | Stripe (US LLC) + PayPal | Native Shopify integration, global reach |

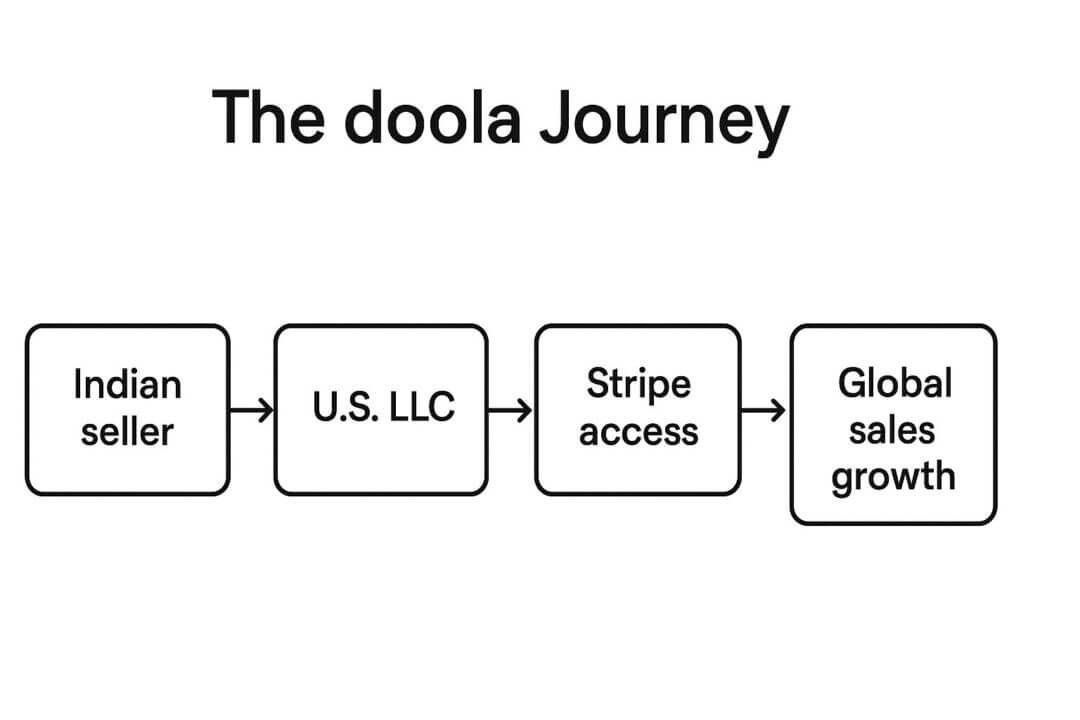

⚡ doola Tip: If you’re eyeing Stripe for global sales, setting up a US LLC with doola can get you live in weeks, not months.

Plus, with doola handling your banking, compliance, and bookkeeping, you can focus on scaling your Shopify store without payment roadblocks.

Accepting International Payments in Shopify India

Running a Shopify store in India is exciting, until you try selling to customers in New York, London, or Sydney and realize your “international payments” aren’t as straightforward as you thought.

Between regulations, fees, and settlement delays, going global from India can feel challenging.

But don’t worry, there are ways to make it work. We’ll break it down for you.

What Are The Key Challenges?

❌ Currency Conversion Fees: Every time a customer pays in USD, EUR, or GBP, the payment processor converts it into INR, often at rates that are less “market rate” and more “surprise fee.” This can eat into your profit margins, especially if your AOV is high.

❌ RBI & FEMA Regulations: Cross-border transactions are subject to Reserve Bank of India (RBI) and Foreign Exchange Management Act (FEMA) rules. That means stricter KYC, mandatory export documentation, and extra scrutiny for large or recurring payments.

❌ Longer Settlement Timelines: Domestic payments in India usually settle in a couple of days, but international ones take 7–21 days based on the gateway and banking intermediaries. This restricts your cash flow, especially if you rely on quick inventory replenishment.

What Are The Solutions?

For Shopify store owners from India, the right solution is about improving checkout experience, minimizing fees, speeding up payouts, and ensuring compliance.

Let’s explore three high-impact options that Indian entrepreneurs are already using to scale internationally.

1. PayPal Business: Easy Setup, Global Coverage

PayPal is the most plug-and-play option for Indian Shopify stores. You can start accepting payments from over 200 countries within hours. The platform is widely trusted by customers, which can boost conversion rates.

However, the trade-off is higher transaction and currency conversion fees compared to other gateways.

2. Stripe via US LLC: Native Shopify Integration, Faster Payouts

Stripe isn’t available for Indian entities, but by forming a US LLC, you can legally access Stripe’s native Shopify integration. This unlocks seamless checkout, faster payouts (2–7 days), and access to advanced payment features.

You’ll also avoid some of the steep FX fees since payments can be held in USD before converting.

3. Wise Multi-Currency Account: Better FX Rates

Wise lets you open virtual accounts in multiple currencies, so you can get paid in USD, GBP, EUR, and more, then convert at mid-market rates with minimal fees.

It’s especially useful if you work with overseas suppliers and want to pay them directly in foreign currency without double conversion losses.

When you’re ready for seamless global payments, forming a US business with doola unlocks Stripe, US bank accounts, and a compliance-ready setup.

How doola Helps Indian Shopify Sellers Expand Globally

Breaking into international markets is exciting, but without the right structure, compliance, and banking access, it can quickly turn into a logistical nightmare.

That’s where doola steps in. We don’t just help you “go global”, we make sure you do it smart, compliant, and future-ready.

Here’s what you get with doola’s services:

- Form your US LLC for instant credibility and payment access: Unlock trusted global payment processors like Stripe, PayPal, and Shopify Payments that require a US entity.

- Get compliance handled without the paperwork headache: From registered agent services to annual state filings, doola keeps your business in good standing year-round.

- Open US bank accounts with ease: Whether it’s Mercury for seamless online banking or Wise for multi-currency transactions, we help you set up accounts that let you receive, hold, and spend in multiple currencies without paying excessive conversion fees.

- Stay tax-compliant: We help you navigate US federal and state taxes, plus ensure your transactions meet compliance standards, so you avoid penalties and keep your global expansion smooth.

With doola by your side, you’re not just selling on Shopify, you’re building a borderless business with the systems, compliance, and financial access to scale worldwide.

Launch Your Global Shopify Business With doola

With the right payment setup, your store isn’t just open for business, it’s open to the world, so you sell seamlessly to customers across continents without worrying about payment roadblocks.

And with doola on your team, you’re not just running a Shopify store, you’re building a global brand that inspires trust, drives growth, and scales beyond borders.

Start accepting all types of payments globally today. Get started with doola today.

FAQs

Can I use Shopify Payments in India?

No, Shopify Payments isn’t available for Indian entities as of 2025. Indian merchants can’t use Shopify’s in-house payment processor directly.

Instead, you’ll need to rely on third-party payment gateways that Shopify supports in India, such as Razorpay, PayU, Paytm, Cashfree, Instamojo, or PayPal.

If you’re aiming for international sales with advanced features, you can also use Stripe via a US LLC (or another supported country entity).

Which payment gateway is best for Shopify India?

It depends on your customer base:

- For domestic sales in India, Razorpay is generally considered the best all-rounder. It supports UPI, cards, wallets, and net banking, and offers fast onboarding.

- For global sales, a combination works best: use PayPal (to quickly build trust with international buyers) along with Stripe (via a US LLC) if you want advanced subscription tools, seamless checkout, and better analytics.

So, the “best” gateway really comes down to whether your priority is Indian customers, global customers, or both.

How do I receive international payments on Shopify from India?

You have two main routes:

- PayPal Business Account: The simplest option. You can link your Indian bank account and start receiving payments from international buyers right away. The tradeoff is slightly higher transaction fees and slower settlement times.

- Stripe via a US LLC: If you want lower friction, advanced developer tools, and recurring billing features, Stripe is a better choice, but you’ll need to register a U.S. business entity first.

Most serious global Shopify sellers in India use both PayPal and Stripe together for maximum coverage.

Do I need a GST number to set up a payment gateway in Shopify?

Yes, in most cases.

Indian payment gateways typically require a GST number (along with a PAN card, bank account details, and business documents) to complete merchant verification. This applies to Razorpay, PayU, Paytm, and others.

That said, some gateways like Instamojo are more freelancer-friendly and may allow individuals without GST registration to start accepting payments.

But if you plan to scale your Shopify store into a serious business, getting a GST number is strongly recommended.

Can I use Stripe in India without a US business?

No. Stripe isn’t officially available in India, so you can’t use it with an Indian entity.

To access Stripe, you’ll need to register your business in a Stripe-supported country, most commonly, Indian entrepreneurs set up a US LLC.

Once you have that, you can open a US bank account, connect it to Stripe, and link everything back to Shopify.

How long does it take to get payouts from Razorpay or PayU?

Both Razorpay and PayU typically follow a T+2 business day settlement cycle. That means if you receive a payment today (T), it’s usually credited to your bank account within two business days.

However:

- For new accounts, settlement might take longer during the initial risk assessment period.

- Some gateways offer instant settlement options for an additional fee if you need faster cash flow.

So, in practice, you can expect your payouts within 48–72 hours on average, unless you opt for instant transfers.

News

Berita

News Flash

Blog

Technology

Sports

Sport

Football

Tips

Finance

Berita Terkini

Berita Terbaru

Berita Kekinian

News

Berita Terkini

Olahraga

Pasang Internet Myrepublic

Jasa Import China

Jasa Import Door to Door

Situs berita olahraga khusus sepak bola adalah platform digital yang fokus menyajikan informasi, berita, dan analisis terkait dunia sepak bola. Sering menyajikan liputan mendalam tentang liga-liga utama dunia seperti Liga Inggris, La Liga, Serie A, Bundesliga, dan kompetisi internasional seperti Liga Champions serta Piala Dunia. Anda juga bisa menemukan opini ahli, highlight video, hingga berita terkini mengenai perkembangan dalam sepak bola.