When a U.S. partnership involves foreign partners, Form 8804 plays a crucial role in ensuring that foreign partners meet their U.S. tax obligations and reporting compliance.

Miss it, or skip required quarterly 8813 deposits, and you can trigger late-filing/late-payment penalties and interest, even if you later file an extension. Here’s how things go wrong:

- After the due date (generally the 15th day of the 3rd month after year-end), interest starts accruing on unpaid 1446 tax, which we’ll cover later.

- Partners never receive Form 8805, which they need to claim credit on their own U.S. returns.

- The IRS will label you non-compliant and start assessing penalties, interest, and balance-due notices until you fix it.

In this guide, we simplify this process. You’ll learn what Form 8804 is, why it exists under section 1446, who must file, and how 8804 works alongside 8805 and 8813.

We’ll give you a step-by-step walkthrough to complete the filing, the deadlines and extensions, and the penalties to avoid.

Get ready for practical checklists and see how doola’s Tax Filing services can help you ensure smoother 1446 withholding, 8804 reporting, and year-end filings.

What Is Form 8804?

Form 8804 is the annual IRS return that reports a partnership’s total withholding tax liability on behalf of its foreign partners.

This obligation comes from Internal Revenue Code Section 1446, which requires both domestic and foreign partnerships that have effectively connected taxable income (ECTI) to pay a withholding tax on the portion of that income allocable to their foreign partners.

Think of it as the IRS’s way of making sure foreign partners in a U.S. partnership pay the right amount of tax while the partnership can claim credits and keep its cross-border operations compliant.

The U.S. requires taxes to be withheld and reported at the partnership level, so the IRS gets its share before profits are distributed.

So, if your partnership has foreign investors and makes money in the U.S., you can’t ignore this form and are responsible for filing and paying tax to the IRS on their behalf.

Remember, filing isn’t just about staying compliant. It keeps your partners protected and your business in the IRS’s good books.

Who Needs to File Form 8804?

Not every partnership must file Form 8804, but if your business has foreign partners and earns U.S.-connected income, chances are you fall under the requirement.

Ask yourself these 3 questions to figure it out:

👉🏼 Does your partnership have one or more foreign partners?

👉🏼 Does the partnership earn U.S.-source income that is “effectively connected” to a U.S. trade or business (ECTI)?

👉🏼 Is that income allocable to foreign partners?

If you answered “yes” to all the above questions, your partnership must file Form 8804. It applies to U.S. partnerships with foreign members or foreign partnerships doing business or generating ECTI in the U.S.

However, foreign partnerships rarely fit into a simple box. Beyond the basic filing requirement, some special scenarios complicate this process.

✔️ U.S. Agent Filing

The responsibility to file still rests with the partnership, but it may appoint a U.S. agent to handle communication with the IRS, including signing and submitting Form 8804.

✔️ Tiered Partnerships

If your partnership invests in another partnership, you still have to report and withhold on the income that ultimately flows through to your foreign partners.

✔️ Missing TINs

If a foreign partner doesn’t provide a U.S. Taxpayer Identification Number (TIN), the partnership must still withhold and report tax on that partner’s share, often at the highest statutory rate.

✔️ Trusts and Disregarded Entities

If a foreign trust, estate, or disregarded entity is a partner, the partnership may still have to withhold and file 8804. The actual “beneficial owner” is what matters, and proper documentation (such as W-8 forms) is required.

There are a few narrow exemptions as well. Here are some cases in which foreign partners may be exempt from withholding under Section 1446:

- In some cases, the foreign partner can file IRS Form W-8ECI certifying that their income is not subject to U.S. withholding because it is effectively connected with a U.S. trade or business and they are already reporting it on their U.S. tax return.

- They can avoid withholding if a tax treaty covers the foreign partner and provides for a reduced withholding rate or exemption from U.S. taxation on certain types of income.

- Some publicly traded partnerships (PTPs) and qualified investment entities (QIEs) may also be exempt from withholding requirements if specific conditions are met.

- The foreign partner’s share of ECTI is effectively zero, or the income is not fixed or determinable, annual or periodic.

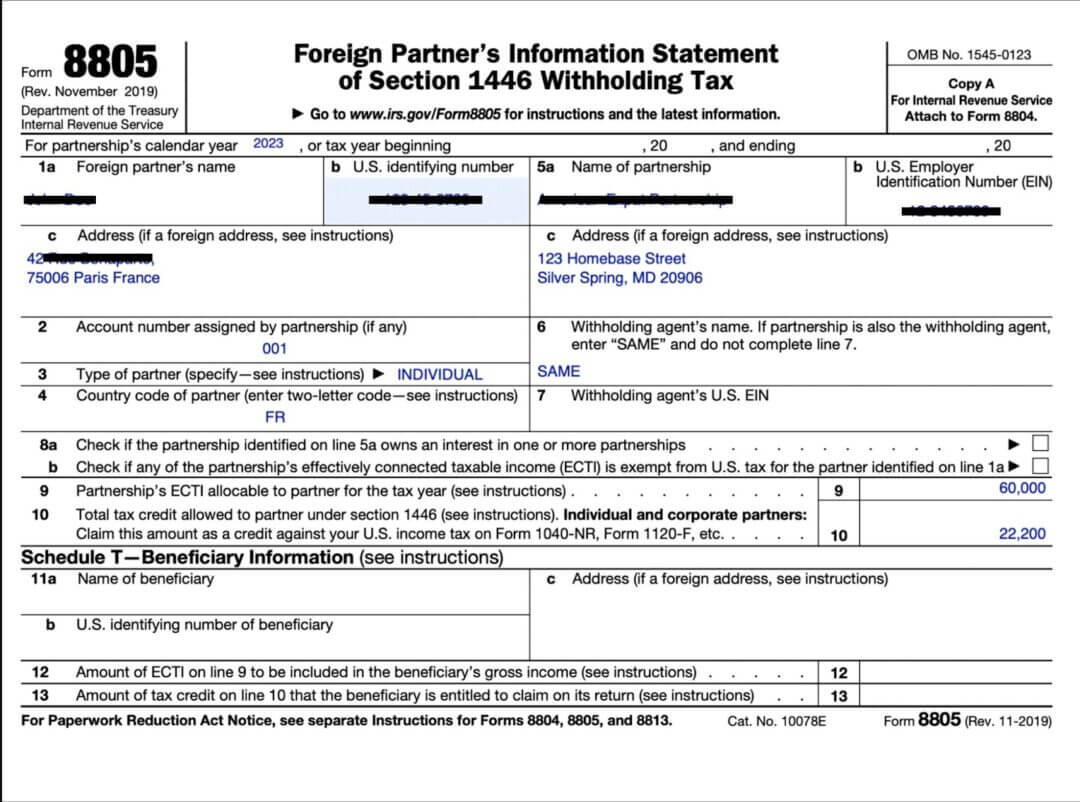

Form 8804 vs. Related IRS Forms (8805 & 8813)

Form 8804 works with Form 8805 and Form 8813 to create a complete picture of how foreign partnership withholding is reported and paid.

Think of them as three moving parts of the same compliance system:

| Form | Purpose | Who Files / Issues It | Who Receives It | Timing | How It Interacts |

| Form 8804 | Annual return that summarizes the partnership’s total §1446 withholding tax liability for the year. | The partnership (or its U.S. agent) files it with the IRS. | IRS | This form is due by the 15th day of the 3rd month after the close of the partnership’s tax year (e.g., March 15 for calendar-year partnerships).

For partnerships that keep their records and books of account outside the United States and Puerto Rico, the due date is the 15th day of the 6th month following the close of the partnership’s tax year. |

Acts as the “master summary” of all withholding, reconciles quarterly 8813 deposits, and matches the partner-level detail reported on 8805. |

| Form 8805 | Statement of each foreign partner’s share of effectively connected taxable income (ECTI) and tax withheld. | The partnership prepares and files copies with the IRS and gives each foreign partner their own 8805. | Each foreign partner + IRS | It must be issued at the same time as partnership files 8804. | Partners use 8805 to claim credit for U.S. tax withheld on their individual or corporate U.S. tax return. |

| Form 8813 | A quarterly payment voucher is used to remit withholding tax installments during the tax year. | The partnership files it with the payment. | IRS | Due quarterly: 15th day of the 4th, 6th, 9th, and 12th months of the partnership’s tax year. | These deposits are later reported and reconciled on Form 8804. Even if Form 8804 is filed on time, missing or late 8813 payments can create penalties. |

Put simply, 8813 handles payments, 8805 breaks down withholding per partner, and 8804 ties everything together in one annual report.

Filing Deadlines for Form 8804

Form 8804 deadlines aren’t just dates on a calendar; they’re compliance checkpoints. Miss one, and the IRS will impose penalties, interest, and notices.

Mark Your Calendar: Standard Due Dates That Matter

If your partnership follows a calendar year, Form 8804 is due March 15 of the following year.

However, if you operate on a fiscal year, the deadline is the 15th day of the 3rd month after your tax year ends.

| Type of Partnership | Standard Filing Deadline | With Extension (Form 7004) | Payment Deadline |

| Calendar-Year Partnership (year ends Dec 31) | March 15 of the following year | September 15 (6-month extension) | Still due March 15 (no extension for payments) |

| Fiscal-Year Partnership (any non-Dec 31 year-end) | 15th day of the 3rd month after year-end (e.g., June 30 year-end → Sept 15 deadline) | 6 months after the standard deadline | Still due on the original filing deadline (no extension for payments) |

For partnerships that keep their records and books of account outside the United States and Puerto Rico, the due date is the 15th day of the 6th month following the close of the partnership’s tax year.

If the partnership is required to make installment payments of the withholding tax, Form 8813 must be filed by the 15th day of the 4th, 6th, 9th, and 12th months of the partnership’s tax year.

Form 7004: An Extension for Filing, Not for Paying

If you can’t file Form 8804 on time, you can request an automatic six-month extension by filing Form 7004. But beware, it extends your filing deadline, not your payment deadline.

Any withholding tax due under IRC §1446 must still be paid by the original deadline through quarterly 8813 deposits or a final catch-up payment.

If you don’t make timely deposits (via Form 8813) or cover the balance owed, penalties and interest will still apply—even if you file Form 7004.

What Happens If You Miss the Deadline

Missing deadlines leads to IRS penalties, which can stack up fast.

⚠️ Late Filing Penalty: Usually 5% of unpaid tax per month (up to 25%). If the return is over 60 days late, there’s a minimum penalty ( $485 or 100% of the tax due, whichever is smaller).

⚠️ Late filing penalty for Form 8805: The penalty for each failure to file a correct 2023 Form 8805 is $310, with a maximum penalty of $3,783,000. Remember to file Form 8805 for each foreign partner, or these penalties can add up quickly.

⚠️ Failing to provide a correct Form 8805 to a foreign partner: The penalty for failure to issue a correct Form 8805 to the recipient is $290 per form, with a maximum penalty of $3,532,500.

⚠️ Late Payment Penalty: Typically 0.5% of unpaid tax per month (up to 25%), plus interest.

⚠️ Partner-Level Consequences: Without timely 8805s (generated from 8804), foreign partners can’t claim their withholding credits, which leads to IRS scrutiny.

| Penalty Escalation Matrix (Missed Deadlines = Compounding Costs) | |

| 1 month late → 5% late filing penalty + 0.5% late payment penalty.

3 months late → 15% late filing + 1.5% late payment + interest. 6+ months late → 25% max filing penalty + 3% payment penalty + interest. 60+ days late → Minimum penalty kicks in, even if no tax is due. |

Step-by-Step Guide to Completing Form 8804

Filing Form 8804 isn’t just about filling in a few blanks. Each section of the form ties into your partnership’s withholding obligations, the IRS’s records, and partners’ ability to claim tax credits.

Below is a practical walkthrough of the major sections, plus tips to avoid mistakes.

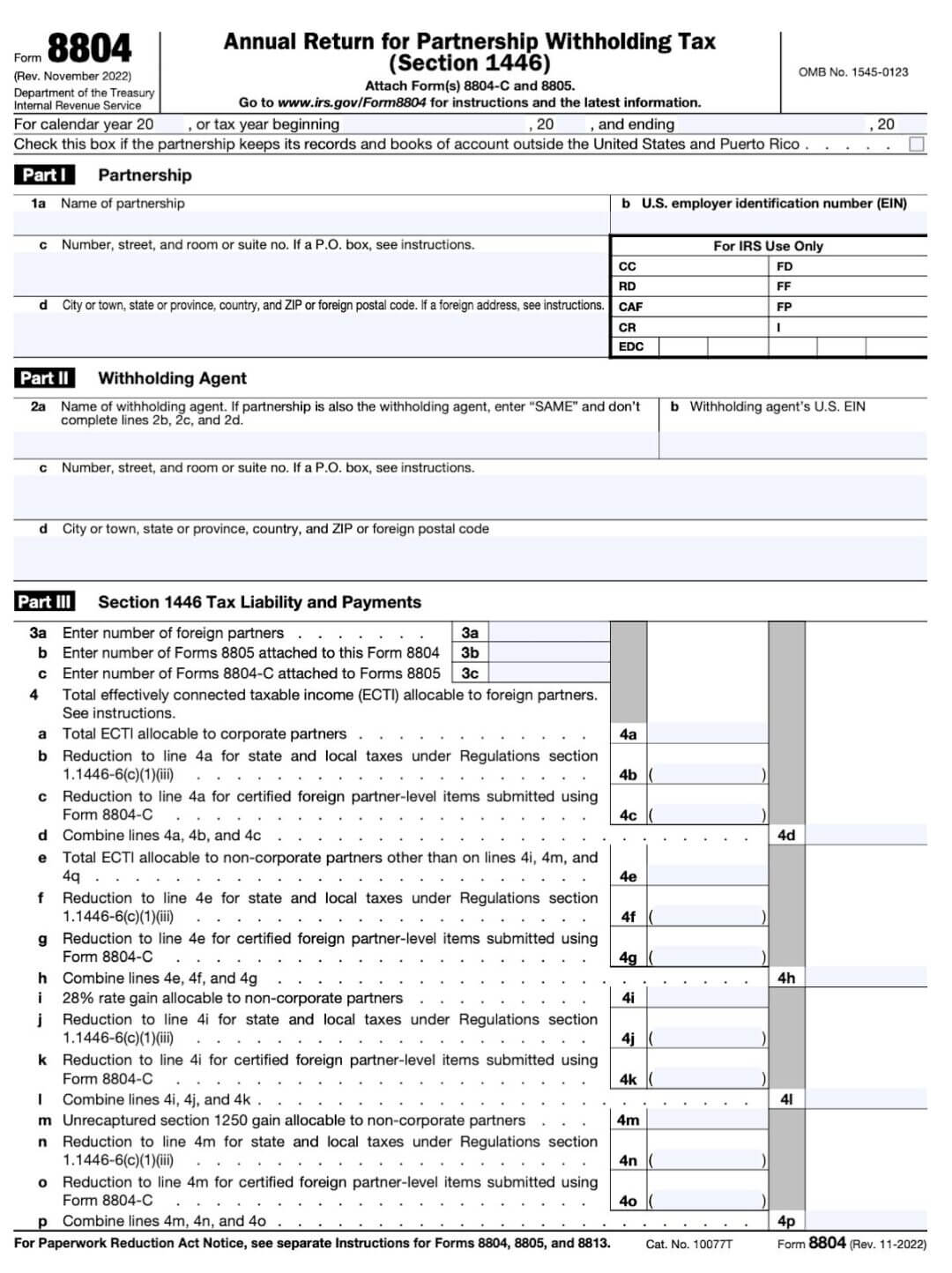

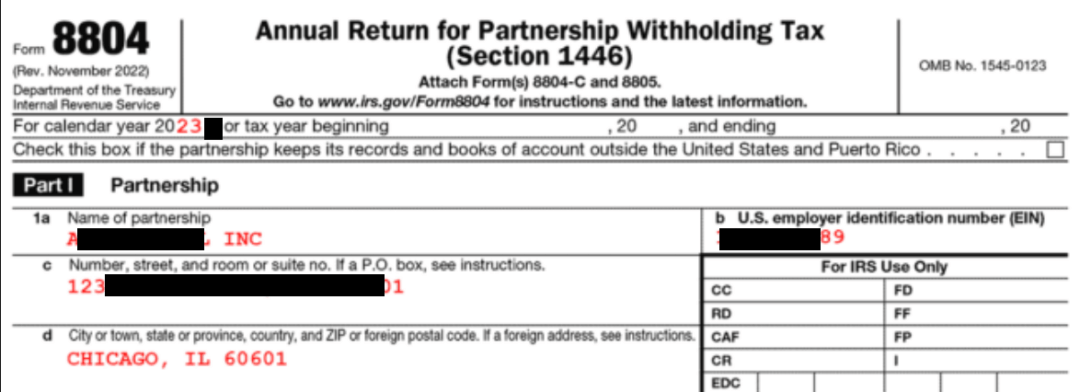

Part I: Partnership Information

At the top of the form, you’ll enter the partnership name, address, EIN (Taxpayer Identification Number), tax year (calendar or fiscal), and the contact information for the responsible party.

Line 1a: Enter the legal name of the partnership.

Line 1b: Provide the partnership’s U.S. Employer Identification Number (EIN).

Line 1c: List the partnership’s street address (no P.O. boxes unless specified in instructions).

Line 1d: Include the city, state, ZIP code, or foreign postal code if applicable.

📌 Pro tip: Make sure the EIN and partnership name match your latest IRS records. Even a small error can delay processing or trigger IRS notices.

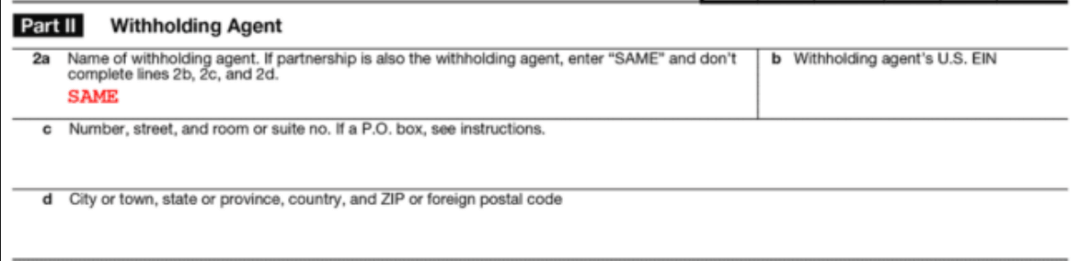

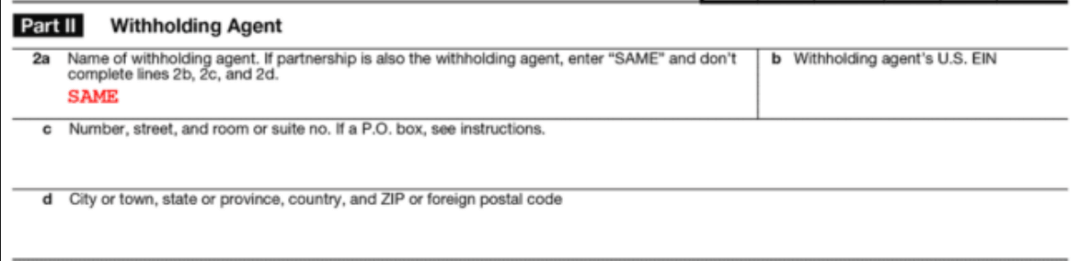

Part II: Withholding Agent Information

It’s the core of Form 8804. A withholding agent is an individual or entity responsible for withholding, reporting, and paying over income tax on behalf of a foreign person.

In the context of Form 8804, this responsibility applies to the tax on a foreign partner’s ECTI.

Line 2a: If the partnership is the withholding agent, write “SAME.” Otherwise, list the agent’s name.

Line 2b: Provide the withholding agent’s EIN (if different from the partnership). Leave empty if you’ve put “SAME” in Line 2a.

Lines 2c–2d: Include the agent’s street address and location details. Leave empty if you’ve put “SAME” in Line 2a.

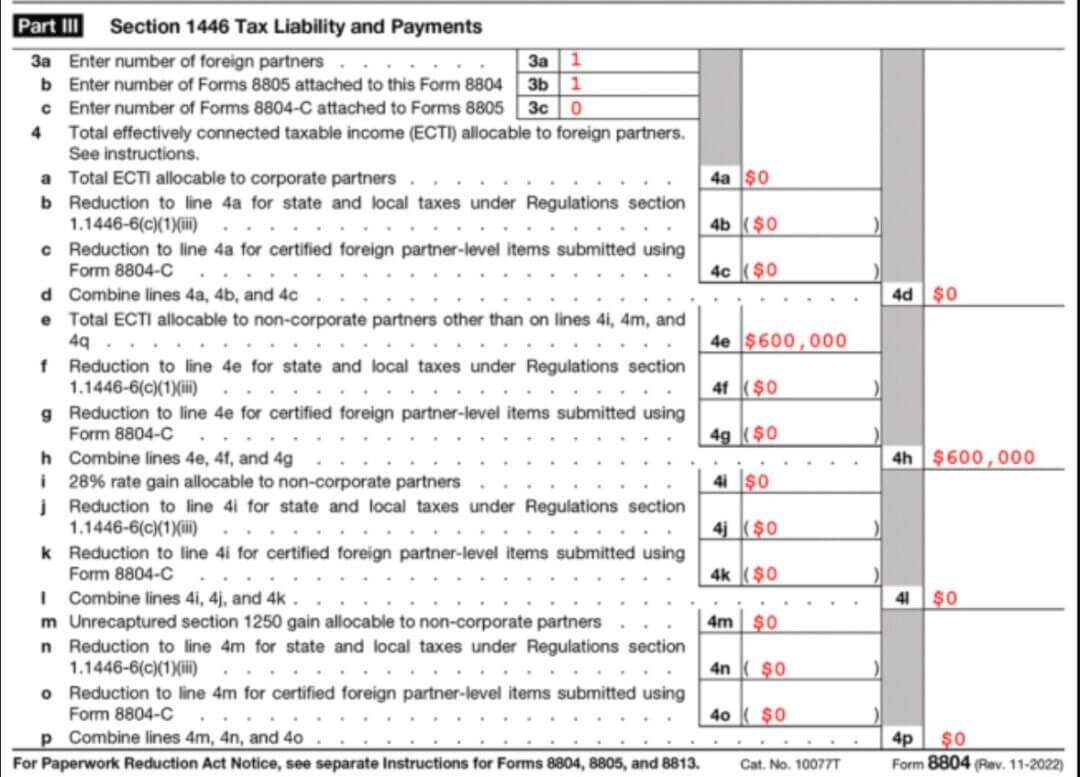

Part III: Section 1446 Tax Liability and Payments

Form 8804 acts similarly to Forms W-2 or 1099-MISC. Partners need this form to claim credit for U.S. taxes withheld when they file their own U.S. tax returns.

For each foreign partner, you must:

- Show their share of ECTI.

- Show tax withheld on their behalf.

- Prepare and distribute Form 8805 to both the IRS and the partner.

In this section, you’ll report gross ECTI allocable to foreign partners. Apply the correct withholding tax rate based on the type of partner (individuals vs. corporations may differ).

For individual foreign partners, the rate often corresponds to the maximum individual income tax rate.

On the other hand, for corporate foreign partners, the rate is usually set at the top corporate tax rate.

Subtract any quarterly installment payments already made using Form 8813 and calculate the total tax liability under section 1446 on your foreign partners’ share of ECTI.

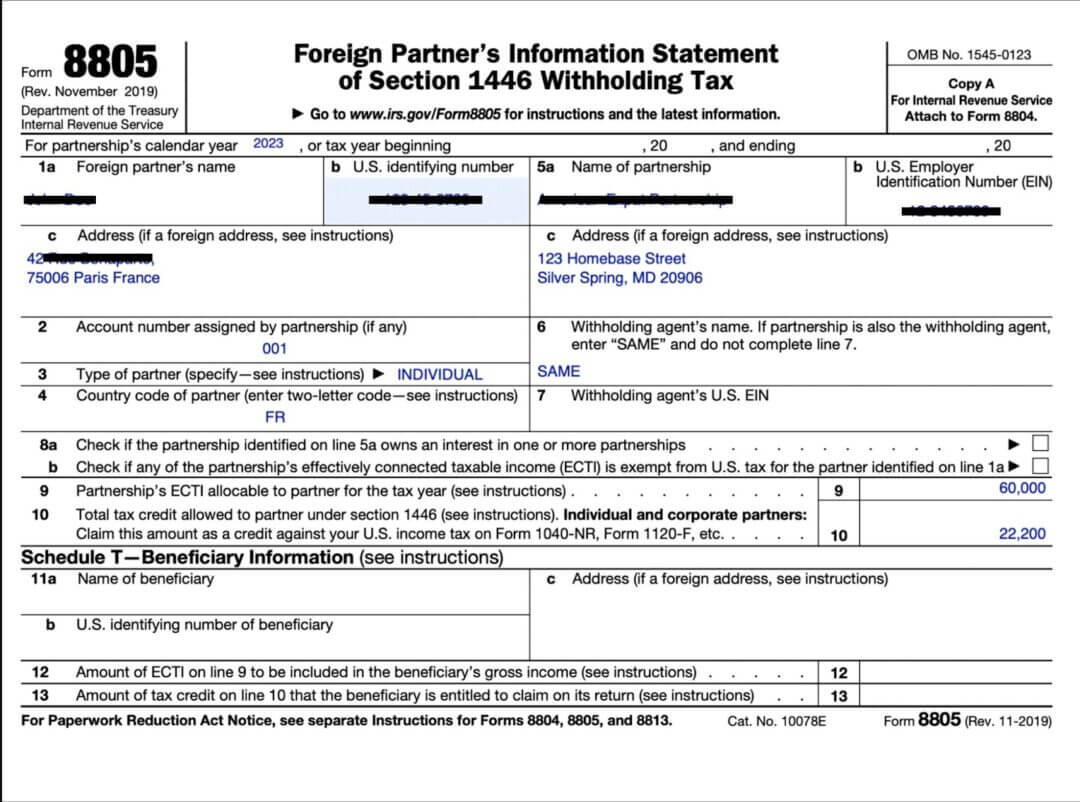

Allocation and Reporting for Each Partner

Form 8804 reports the overall withholding for the partnership, and Form 8805 reports the specific tax withheld for each foreign partner.

Each foreign partner receives a copy, which details their share of the ECTI and the tax withheld on their behalf. This includes:

- The foreign partner’s name, address, and identification number

- The partner’s share of ECTI

- The amount of tax withheld on the partner’s behalf under Section 1446

Key Tips for Filing Form 8804

The IRS may request additional documentation if there’s an audit or discrepancy. Be prepared to attach or keep supporting documents in your records:

- ECTI calculations from the partnership return (Form 1065).

- Form 8804-C for certified adjustments and Form 8805 (per foreign partner).

- Partner-level allocations showing how income and withholding were split.

- W-8 forms from each foreign partner (e.g., W-8BEN, W-8BEN-E, W-8ECI) to confirm foreign status and treaty eligibility.

- Schedule K-1 (Form 1065) for each foreign partner, providing their respective share of income, deductions, and credits, must also be filed by the partnership.

- Supporting documents substantiating the partnership’s income, deductions, and credits.

Even slight mismatches between 8804 and 8805 or miscalculations in totals can be the cause of common triggers for IRS notices. Avoid this by:

✔️ Verifying partner details (names, addresses, TINs).

✔️ Confirming that all quarterly Form 8813 deposits are accounted for.

✔️ Matching totals on 8804 with the sum of all 8805s.

✔️ Reconciling ECTI allocations with your partnership’s books and Form 1065.

If you discover an error after filing, you can file an amended Form 8804 with corrected figures and issue corrected Form 8805 statements to affected partners.

You may also need to pay any additional withholding tax owed promptly to minimize penalties and interest.

📌 Pro Tip: Always treat Form 8804 as part of a system with Form 8813 (quarterly deposits) and Form 8805 (partner statements).

Form 8804 Filing and Submission

The final step is submitting your completed form, signed by an authorized partner or representative of the partnership.

To submit Form 8804, follow the filing instructions provided by the IRS, which include mailing it to the appropriate mailing address based on the partnership’s location.

The IRS supports electronic filing only for Form 1065 and the extension Form 7004. Forms 8804, 8805, and 8813 aren’t included in the electronic file and need to be filed on paper.

You can mail the completed Form 8804, Schedule K-1s, and any required attachments to the appropriate IRS address:

Internal Revenue Service Center

P.O. Box 409101

Ogden, UT 84409

Penalties and Compliance Risks

Because Form 8804 involves withholding tax on behalf of foreign partners, the government enforces strict penalties for delays, underpayments, and reporting errors.

In addition to the penalties for late filing of Form 8804 and late payment of withholding tax covered earlier, the IRS may impose information return penalties under sections 6721 and 6722.

This can include $310 per missing or incorrect form, with higher amounts if there’s intentional disregard.

For example, a foreign-owned partnership with two foreign partners and $500,000 of ECTI forgets to make quarterly 8813 deposits and files Form 8804 three months late.

What started as a missed deadline quickly became a six-figure problem:

- Withholding liability: ~$185,000 (assuming 37% top rate).

- Late filing penalty: 15% of unpaid tax = ~$27,750.

- Late payment penalty: 1.5% of unpaid tax = ~$2,775.

- Interest charges: Continue to accrue until the balance is paid.

- Partner-level issue: Both foreign partners have yet to receive Form 8805, which prevents them from claiming U.S. withholding credits on time.

If your partnership misses a deadline or files incorrectly, the IRS will issue a notice. Here’s how to handle it:

✔️ Read carefully: The notice will specify whether the issue is late filing, late payment, missing partner information, or underpayment.

✔️ Confirm the numbers: Cross-check your 8804, 8805, and 8813 records to identify mismatches.

✔️ Respond quickly: Deadlines to respond are usually 30 days. Delays make penalties and interest worse.

✔️ Pay what you owe: If the IRS is correct, pay the outstanding tax plus penalties as soon as possible to stop interest from compounding.

✔️ File corrections: If the notice points to missing or incorrect 8805s, re-issue corrected forms to both the IRS and affected partners.

✔️ Seek help if needed: Complex cases (like treaty claims or tiered partnerships) often require professional support.

Practical Tips for Foreign Partnerships Filing Form 8804

With proactive preparation, recordkeeping, and communication, you can stay compliant without last-minute stress. Here’s a practical playbook to guide your partnership.

- Partner information: Names, addresses, U.S. or foreign status, and Taxpayer Identification Numbers (TINs).

- Prior year forms: Previous Form 8804 and Form 8805 statements for consistency checks.

- Supporting financials: Profit & loss statements and allocation schedules that show each partner’s share of effectively connected taxable income (ECTI).

- W-8 series forms: W-8BEN, W-8BEN-E, or W-8ECI from each foreign partner to confirm status and any treaty benefits.

- Schedule K-1s: To tie partner allocations from the partnership return (Form 1065) to Form 8804 reporting.

- Quarterly payment records (Form 8813): Proof of deposits already made to the IRS.

Build Reliable Systems for Recordkeeping and Collaboration

Good recordkeeping is the backbone of compliance. Keep a centralized ledger that tracks quarterly Form 8813 deposits and reconciles them against the final 8804.

This will help you maintain partner-level ECTI allocations throughout the year and store all partner documentation (W-8 forms, K-1s, correspondence) in one secure location.

To avoid delays, send template emails/reminders or request letters for missing TINs or W-8 forms so partners know exactly what’s required.

Coordinate with your tax advisor or bookkeeping team to ensure the numbers on Form 1065, 8804, and 8805 match.

FAQs About ECTI

👉🏼 What if we need to amend a previously filed Form 8804?

File an amended Form 8804 and issue corrected Form 8805s to affected partners, but make sure you pay additional withholding immediately to reduce penalties and interest.

👉🏼 How do we handle a partner who leaves mid-year?

You must still allocate ECTI and withhold tax for only the period they were a partner, then provide them a Form 8805 for that year.

👉🏼 What happens if our ECTI is negative?

No withholding is due, but you must still file Form 8804 to report the results. It’ll help you maintain IRS compliance and provide partners with transparency.

👉🏼 Do we need to file Form 8804 if all partners provided W-8ECI forms?

If valid W-8ECI forms are on file, withholding may not apply, but the partnership often still files Form 8804 to document compliance. Check out IRS guidelines for Form 8804, 8805, and 8813.

How doola Helps With Form 8804 Filing

A single mistake in filing Form 8804, like a miscalculated withholding, a missing TIN, or a late quarterly deposit, can trigger IRS penalties and strain relationships with your foreign partners.

With doola Tax Filing services, you get it right every time. Our expert tax team simplifies compliance and keeps your business aligned with IRS and state requirements.

🚀 Automated Calculations and Accuracy: The math is automated, reducing the risk of costly errors from partner-level allocations to total withholding.

🚀 Organized Forms and Documentation: doola organizes everything in one place, ensuring partner data, prior filings, and quarterly deposits are aligned and ready when you need them.

🚀 Issue Detection Before It’s Too Late: Our system has safeguards to catch red flags like mismatched totals, missing TINs, or incorrect ECTI allocations so they don’t lead to IRS notices or penalties.

🚀 Stay Ahead of Deadlines: We track all key dates, remind you before filings are due, and ensure payments are made on time so you never risk falling out of good standing with the IRS.

Sign up today and see how doola keeps your partnership compliant, organized, and investor-ready.

FAQs

What happens if a foreign partnership doesn’t file Form 8804?

Failure to file Form 8804 means foreign partners can’t claim credit for U.S. taxes withheld, which jeopardizes the partnership’s standing with the IRS.

They may also face penalties, including a late filing penalty of 5% of the unpaid tax for each month or part of a month, up to 25%, with a minimum penalty if filed over 60 days late.

Can Form 8804 be filed electronically?

No, the IRS does not support electronic filing for Form 8804, Annual Return for Partnership Withholding Tax (Section 1446).

You must file Form 8804 and its related Forms 8805 on paper and mail them to the appropriate address.

How does Form 8804 affect individual foreign partners?

Form 8804 is the summary report that allows the partnership to issue Form 8805 to each foreign partner.

Partners use the information in Form 8805 to claim a credit for U.S. withholding tax when they file their own U.S. tax returns.

Without 8805, they can’t prove withholding occurred, which can lead to double taxation.

Is Form 8804 required if the partnership had no U.S. effectively connected income?

Many partnerships still file Form 8804 with “zero” reported, especially if they have foreign partners.

Filing even when there’s no liability is a good practice for transparency since it provides a compliance record and avoids IRS questions later.

What is the difference between Form 8804 and Form 1065?

Think of 1065 as the “full tax return” for the partnership and 8804 as the “withholding report card” for the IRS and foreign partners.

Form 8804 reports and pays the withholding tax liability under Section 1446 for foreign partners.

On the other hand, Form 1065 is the partnership’s annual income tax return, showing income, deductions, and allocations for all partners (foreign and U.S.).

Can a U.S. withholding agent file Form 8804 on behalf of a foreign partnership?

Yes. A foreign partnership can appoint a U.S. withholding agent to file Form 8804, submit 8813 payments, and handle IRS communications.

doola Bookkeeping has been perfect for many solo setups. Handles invoicing, expense tracking and tax prep in one place without overwhelming complexity.

You should check out doola Bookkeeping for help handling all the heavy lifting, including transaction synchronization and categorization, invoicing, financial statements, reconciliation, and year-end tax prep.

And if things get more complex, like mixed cash/credit deposits and accrual adjustments, you have a dedicated bookkeeper who can handle that too, so you don’t outgrow the system.

News

Berita

News Flash

Blog

Technology

Sports

Sport

Football

Tips

Finance

Berita Terkini

Berita Terbaru

Berita Kekinian

News

Berita Terkini

Olahraga

Pasang Internet Myrepublic

Jasa Import China

Jasa Import Door to Door

Situs berita olahraga khusus sepak bola adalah platform digital yang fokus menyajikan informasi, berita, dan analisis terkait dunia sepak bola. Sering menyajikan liputan mendalam tentang liga-liga utama dunia seperti Liga Inggris, La Liga, Serie A, Bundesliga, dan kompetisi internasional seperti Liga Champions serta Piala Dunia. Anda juga bisa menemukan opini ahli, highlight video, hingga berita terkini mengenai perkembangan dalam sepak bola.